-40%

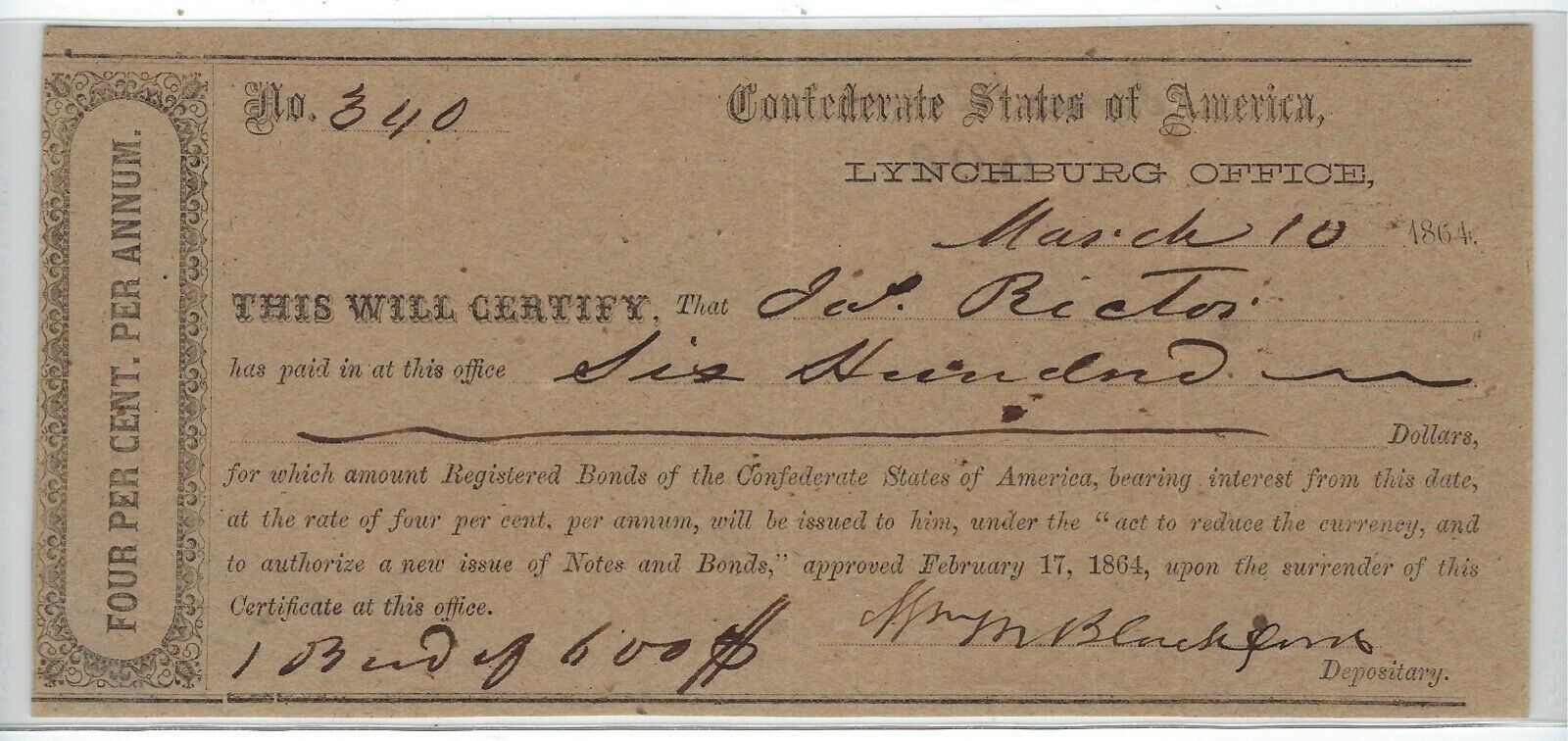

Virginia-92 1864 0 Confederate IDR - Lynchburg

$ 42.24

- Description

- Size Guide

Description

VA-92. March 10, 1864. 0.00.Lynchburg, VA interim depository receipt.Serial number 340. Plen none.

Very Fine to Extremely Fine using traditional grading. Great color and eye appeal for the type.

Genuine.

Beginning in 1862, new bond issues shifted from monetary financing to currency reform and refunding as a primary purpose. The elimination of excess paper money was critically important to price stability. These “refunding” bond programs were not compulsory until the Act of February 17, 1864, which converted treasury notes into long-term bonds or currency at a scaled down value. Unfortunately, mandatory currency refunding was too long delayed. Inflation continued and Confederate currency was virtually worthless by the end of the war.

Because of the continuous monetary reforms, the Treasury substituted temporary certificates and interim receipts to keep pace with the rapid schedule of bond issues. (Treasury receipts issued for payments such as taxes, tariffs and fees, were permanent proof of payment.) Temporary (interim) documents, instead, represented an executory transaction that was completed by the issue of new bonds or currency.

Pierre Fricke. Immediate Past President of the Society of Paper Money Collectors; Professional Numismatists Guild (PNG); Professional Currency Dealers Association (PCDA); ANA, EAC, etc...

BuyVintageMoney.

Author of the standard guide book to Confederate money - Collecting Confederate Money Field Edition 2014.

Free shipping and insurance.

eBay has announced that it will start to collect sales tax on behalf of sellers for items shipped to customers in Alabama (Jul 1), Connecticut (Apr 1), Iowa (Feb 1), Minnesota (Jan 1), New Jersey (May 1), Oklahoma (Jul 1), Pennsylvania (Jul 1), and Washington (Jan 1). Additional states are being added like Idaho and more than 20 others. This is the new internet tax out of the US Supreme Court Wayfair decision. Buyers are responsible for paying this sales tax.

See eBay information for list of states eBay charges this tax payable by buyers to eBay as part of eBay invoices -- https://www.ebay.com/help/selling/fees-credits-invoices/taxes-import-charges?id=4121#section4